Posts Tagged ‘abundance’

Underconsumption

According to this article, people in the United States spent just under $400 million on Halloween costumes for pets in September of this year. That doesn’t include the people who waited until the last minute to find an outfit for Poochie.

It is worth reflecting on this because, a hundred years ago, we didn’t have any experience with living in a society with the scale of wealth we have presently. Many educated and sophisticated thinkers did not believe it would have been possible to have that kind of spending on pets. Instead, they thought that, as an economy grew and basic needs were met, “the masses” would simply stop spending and economic growth would ceiling out, resulting in perpetual unemployment and poverty.

The roots of this argument go back to Thomas Malthus, who obtained for economics the colloquial label “the dismal science.” Malthus is most famous for his law of population and wages that he put forward in his 1798 book An Essay on the Principle of Population, in which he wrote that population growth would always push wages down to the subsistence level, where population growth would be checked by poverty.

The power of population is so superior to the power in the earth to produce subsistence for man, that premature death must in some shape or other visit the human race. The vices of mankind are active and able ministers of depopulation. They are the precursors in the great army of destruction; and often finish the dreadful work themselves. But should they fail in this war of extermination, sickly seasons, epidemics, pestilence, and plague, advance in terrific array, and sweep off their thousands and ten thousands. Should success be still incomplete, gigantic inevitable famine stalks in the rear, and with one mighty blow levels the population with the food of the world.

— An Essay on the Principle of Population, chapter VII, paragraph

The assertion that “[t]he power of population is so superior to the power in the earth to produce subsistence for man” is fundamental to both Malthus’ thought and other arguments for underconsumption. In the 19th century, David Ricardo argued against this. Orthodox economic thought sided with Ricardo against Malthus on the issue of growth. However, like many other ideas, the concept did not go away. Marx, for one, picked up on it as an essential contradiction that could not be resolved and would bring down capitalism.

The idea also is related to the paradox of thrift, in which a society in which everyone saves does not prosper. There are various forms of this, with different conditions around what saving entails and what conditions are necessary, but the basic line of thought is that if everyone is saving, there will be insufficient consumption. Observations of this paradox go back to antiquity.

People curse the one who hoards grain,

but they pray God’s blessing on the one who is willing to sell.

— Proverbs 11:26, New International Version

In the 1920s, the duo of Catchings and Foster published a series of then-influential books on the topic of underconsumption. William Trufant Foster was an academic; Waddill Catchings was an investment banker. They had known each other as classmates at Harvard. They argued that government spending, notably on large public works programs, was necessary or consumption would fail to keep up with production in the economy as a whole, leading to a state of permanent depression. Their ideas were known to both Herbert Hoover and Franklin Delano Roosevelt, and their influence can be seen in the Public Works Administration and the National Industrial Recovery Act.

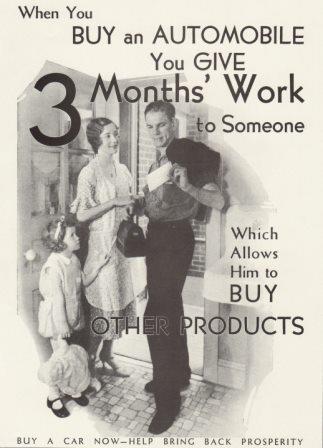

Believing is seeing. When the Great Depression came and settled in for a long stay, followers of underconsumption theory said, “So the condition of permanent depression has arrived, just like the theory said it would.” There were even posters exhorting people to spend money:

Look at Social Security as an example. The idea that you should expect Social Security to supplement your savings for your own retirement is rather recent. In the thirties, we absolutely did not want you to be saving for your own retirement. We wanted you spending what you made right now to get the economy moving again. In this thinking, the economy depends on a continuous flow of money through you: you earn and you spend. Saving is a “leakage” out of this flow and ultimately results in economic catastrophe, a manifestation of the paradox of thrift.

John Maynard Keynes accepted underconsumptionist thinking as a starting point:

Practically I only differ from these schools of thought in thinking that they may lay a little too much

emphasis on increased consumption at a time when there is still much social advantage to be

obtained from increased investment. Theoretically, however, they are open to the criticism of

neglecting the fact that there are two ways to expand output. Even if we were to decide that it would

be better to increase capital more slowly and to concentrate effort on increasing consumption, we

must decide this with open eyes after well considering the alternative. I am myself impressed by the

great social advantages of increasing the stock of capital until it ceases to be scarce. But this is a

practical judgment, not a theoretical imperative.

— The General Theory of Employment, Interest and Money (1936), Chapter 22, Section VI

Keynes was seeking greater levels of investment rather than consumption to stimulate the economy, but so were Catchings and Foster when they advocated public works projects. Furthermore, this begs the question of where the returns to the investment were going to come from. Could you just keep up a perpetual cycle of investment, where your investment causes you to buy from me, and then I invest to meet your demand and buy from you? What happens when the “animal spirits” assert themselves and one of us loses confidence, shutting off the investment spending?

In actual practice, all these thinkers seem to be somewhat lacking in imagination — and possibly somewhat smug about what “the masses” were capable of. Since then, we have seen a consumption explosion and an economy that few people from a hundred years ago could have imagined. An economy where people can spend almost $400 million on Halloween costumes for pets in one month.

Nevertheless, the consequences of this thinking are all around us, in the legacy of design decisions made in the face of a depression or the fear that we would have another one. It is important to understand what those decisions were and why they were made.

An Economic Stimulus Parable

Imagine yourself as a Renaissance prince or princess, ruling a small city-state. One of the your princely possessions is a granary, where you can store grain you purchase in years of abundant harvests and release it in years of famine.

Recent years have been relatively bountiful, but not spectacular and not for everyone. Poor people gathered around you as you traveled through the street, imploring you to help them. The pain on their faces was palpable. It was somewhat embarrassing, sitting on your horse in your silks and jewels, surrounded by these clamoring poor people in their rags. They look like bags of bones, even the children. The sight nagged at your conscience. So you released grain from the granary to feed these people. Everyone in your court praised your benevolence. They’re courtiers, so they would have praised anything you did, but still, they had a point, no?

Last year your whole region did not have good weather, and you had an inadequate harvest. This year was even worse. Famine stalks the land. So you have turned to the keepers of your granary, who report that the store is depleted. There isn’t enough grain to see the people through the winter. Starvation is staring you in the face. What are you going to do?

You write to your neighboring princes. However, they have had the same bad weather and inadequate harvests you have experienced. Everyone is hard up. The few rulers who have any surplus to sell are besieged with offers. Prices are sky-high.

You decide to try coining more money in order to pay for grain. But with more of your money in circulation, chasing the same amount of wealth, prices go up. Your neighbors aren’t stupid; they know that you have put more money in circulation, so each coin is worth less than it was before. They discount the value of your money in exchange for grain, goods or anything else of value.

Now what do you do? You watch your subjects starve. Or you hide in your palace and avoid watching, but your subjects still starve.

The Relevance

What is the difference between the United States and this fictional Renaissance ruler?

- The United States has so much wealth that people think there is no limit, and nothing really bad will ever happen;

- The United States prints the currency used in international trade, and so appears to have greater ability to debase its currency and get away with it;

- The economy of the United States is so complex that it is much harder for people to trace cause and effect relationships, which is the reason for this parable.

The foundation of the first belief is the fiction of material abundance.

When people think they are getting away with an action, restraint goes out the window. What was yesterday’s pushing the envelope becomes tomorrow’s baseline. The only thing that makes them stop is visible, unqualifiable failure.

When the prince gets into trouble, the obvious response is to coin more money. However, making more money doesn’t make more grain. With more money chasing the same amount of grain, prices go up. This is inflation.

There really is not a lot that the prince can do when the famine hits. The key decision was made when he reached into the granary during times of abundance.

Much like with the housing bubble that burst in 2008, you will someday hear people talking about stimulating the economy and saying things like, “It worked until it didn’t.” This is a sure sign of bad risk management.

Material Scarcity

Currently, there is an extensive debate going on both here and in Europe as to whether austerity or some form of pump-priming is called for to rectify the problems in the economy. Both sides have persuasive arguments, yet seem to be talking past one another. There seems to be a basic difference that is not being addressed. Without discussing it and resolving it, any agreement on conclusions is at best accidental and temporary.

Meanwhile, you can plug the term post-scarcity into the search engine of your choosing and find all kinds of material purporting to explain how we live in an age of abundance, and scarcity is a thing of the past. They people writing this content are often articulate and, one infers, intelligent. So why do they think this?

To answer these questions, we have to go back in history. We must return to the birth of macroeconomics and the creation of the world as we have come to know it.

Urbanization and the Great Depression

Prior to about 1850 here, or 1800 in England, the workings of the economy were very simple. Most people were engaged in the production of food. There were few factors of production available to produce anything other than food. Manufactured goods were relatively expensive compared to what they are today. The pre-industrial economy was basically a subsistence agricultural economy with relatively little surplus. Agricultural production was heavily dependent on labor, and that labor needed most of the product for its own maintenance. When conditions adversely affected food production, such as bad weather, famine ensued.

Through deliberate capital formation and risk management, the West crawled out of subsistence during the 1800s. As manufactured goods became cheaper, there was more scope to substitute capital for labor. The released labor moved to the cities and became available to produce more manufactured goods, and a virtuous cycle began. By 1920, there were more Americans living in towns and cities than on farms. This was not thought possible one hundred years earlier.

But around 1930, an inexplicable disaster arrived. Economic activity just stopped, and few people really understood why. Worse, it seemed that any rational action by any participant just made the situation worse. When people reacted to the uncertainty of future incomes by cutting spending, production or lending, these actions just accelerate the problem.

The government took to putting up posters such as the one above, exhorting people to buy consumer goods. But when their own incomes were uncertain, they didn’t dare make that kind of commitment. They pulled back, as did factory owners and lenders. In fact, the pro-cyclical policies of the Federal Reserve turned a bad business downturn into an epic depression.

At the height of the Depression, it seemed as if everything had come unglued. George Orwell captures the spirit and feeling in this often-quoted passage from The Road to Wigan Pier:

We walked up to the top of the slag-heap. The men were shovelling the dirt out of the trucks, while down below their wives and children were kneeling, swiftly scrabbling with their hands in the damp dirt and picking out lumps of coal the size of an egg or smaller. You would see a woman pounce on a tiny fragment of stuff, wipe it on her apron, scrutinize it to make sure it was coal, and pop it jealously into her sack. Of course, when you are boarding a truck you don’t know beforehand what is in it; it may be actual ‘dirt’ from the roads or it may merely be shale from the roofing. If it is a shale truck there will be no coal in it, but there occurs among the shale another inflammable rock called cannel, which looks very like ordinary shale but is slightly darker and is known by splitting in parallel lines, like slate. It makes tolerable fuel, not good enough to be commercially valuable, but good enough to be eagerly sought after by the unemployed. The miners on the shale trucks were picking out the cannel and splitting it up with their hammers. Down at the bottom of the ‘broo’ the people who had failed to get on to either train were gleaning the tiny chips of coal that came rolling down from above—fragments no bigger than a hazel-nut, these, but the people were glad enough to get them.

That scene stays in my mind as one of my pictures of Lancashire: the dumpy, shawled women, with their sacking aprons and their heavy black clogs, kneeling in the cindery mud and the bitter wind, searching eagerly for tiny chips of coal. They are glad enough to do it. In winter they are desperate for fuel; it is more important almost than food. Meanwhile all round, as far as the eye can see, are the slag-heaps and hoisting gear of collieries, and not one of those collieries can sell all the coal it is capable of producing.

The scene defied explanation. There was labor available to produce, but no labor was wanted. The means of production were there, but were laying unused and decaying. The raw materials were there, but there was no effort to extract them, for they could not be sold. What happened? More importantly, how could we make it stop, returning to the conditions of prosperity?

Demand Management

Intelligent, caring, earnest people looked at this situation and concluded that the basics of existence had changed: we were no longer constrained by the supply of wealth, but by the demand for it. They reasoned that, with the onset of urbanization and mechanization, we were now living in a time of material abundance, not scarcity.

This notion was not entirely new at the time. Catchings and Foster had done influential work in the 1920s developing the theory of underconsumption. Once the economy had reached a level where there was sufficient food, clothing and shelter for most people, would they become sated and just stop consuming? If they did, would the economy seize up? Could that be the underlying cause of the Depression?

Demand for wealth, not supply, was now seen as the bottleneck. As such, all the truisms of the past were inverted. The problem of economics would not be production, but distribution. Say’s Law had said that supply creates its own demand; in this new world, demand would create its own supply. Create the demand and the wealth to meet it would come from somewhere.

There was no effective competing theory available. Andrew Mellon’s liquidationism was manifestly unacceptable; these were real people — and real voters — living in Hoovervilles. The economic and political establishment was largely uninterested in the Austrian School.

While FDR never got the economy out of the hole until war production began in earnest in 1940, he was seen by the public to be Doing Something. Even though people who lived through it remembered that unemployment did not really return to normal until the war began, they still remembered FDR as the leader who saw us through the Depression. The grief captured on the newsreels when he died was genuine.

During the 40s and 50s, the new demand-based approach seemed to work. America outproduced its enemies in World War II. After the war, instead of a ruinous inflation and reversion to widespread unemployment that had been forecast, America experienced unprecedented prosperity.

As we entered the sixties, economic experts in government were confident that they could fine-tune the economy and smooth out the business cycle. Other thought leaders looked forward to a time when we would end poverty and include all Americans in prosperity.

So What Went Wrong?

There were several incorrect assumptions and faulty expectations baked into this cake; they shall be subjects of their own articles, as detailed treatment of them is outside the scope of this post. Among them:

- The fact that most of the developed world outside America had been reduced to pre-industrial conditions by the war was overlooked. Even Britain, who won the war, was impoverished by the necessity of beating plowshares into swords.

- The Johnson Administration tried to implement a guns-and-butter policy, launching the Great Society programs and conducting the Vietnam War.

- Political vote-buying accelerated, making ever-greater promises to larger numbers of people.

- There was a general hubris among the population, having overcome the Depression and won the War, leading to an exaggerated sense of what could be accomplished.

However, a fundamental problem that underpins many of the above is the fallacy of material abundance. Demand is not the bottleneck. No matter how affluent people become, their wants will still exceed the resources available to satisfy them.

The thinkers and would-be planners had thought that the masses would content themselves with having their basic material needs met, and demand would have to be stimulated. But that is not the way it played out:

They were heading out to the suburbs — the suburbs! — to places like Islip, Long Island and the San Fernando Valley of Los Angeles — and buying houses with clapboard siding and pitched roofs and shingles and gaslight-style front-porch lamps and mailboxes set up on lengths of stiffened chain that seemed to defy gravity, and all sorts of other unbelievably cute or antiquey touches, and they loaded these homes with “drapes” such as baffled all description and wall-to-wall carpeting you could lose a shoe in, and they put barbecue pits and fish ponds with concrete cherubs urinating into them on the lawn out back, and they parked twenty-five-foot-long cars out front and Evinrude cruisers up on tow trailers in the carport just beyond the breezeway.

— Tom Wolfe, “The Me Decade and the Third Great Awakening”, Mauve Gloves & Madmen, Clutter & Vine (1976)

There was no underconsumption. There was no problem with demand. As long as the ability to pay, to provide value in exchange for value, was present, demand would take care of itself.

By the 1970s, we had the curious phenomenon of stagflation, a portmanteau of stagnation + inflation, which Keynesian orthodoxy preached was impossible. This was an early warning of troubles to come, and provoked some rethinking in economics. It barely rippled out to public policy.

In response to stagflation and the oil price shocks of the time, there was a brief notional flirtation with a return of focus to supply at that time, captured in the school commonly known as supply-side economics. However, this school had limited objectives, arguing for lower tax rates for the good of the collective — overall increase in growth and government receipts — rather than justifying these on an individualist basis. The mere recognition that supply had an active influence on the market was radical as it was. There was little rethinking of the macroeconomic focus on demand.

More recently, there was the downturn of 2001-2002, documented here: http://www.sjsu.edu/faculty/watkins/rec2001.htm. At the time, it was recognized that consumers were carrying the economy. How were they doing it? They were dissaving. They were increasing their debt levels. They were withdrawing equity from their homes, through second mortgages, home equity lines of credit and cash-out refis. This had to end sometime, and ultimately it did.

The consumer couldn’t go the distance, but consumers don’t have a printing press. What about the government? The support of demand through government debt will ultimately fail as well. In FY 2012, Federal debt service was 5.5% of federal spending. Of the total of federal spending, only 81.8% was covered by revenue [based on data from http://www.usgovernmentspending.com]. Thus, revenue can’t keep up with spending and interest, the interest rolls into the balance due, and the interest compounds. Eventually, unless something gives, debt service will devour the federal budget.

The most powerful force in the universe is compound interest.

— attributed to Albert Einstein

Eating the Seed Corn

A fundamental but often-forgotten assumption behind macroeconomics is that the overriding majority of consumers are also the producers. They are producing the increased wealth, a share of which they take home as wages. These wages support the ability do satisfy the demand in the marketplace.

There will be a small minority of people who do not produce. Police are an example. Enforcing the law is very necessary, but it is not a wealth-creating activity. The economy has to create enough surplus wealth to pay for the enforcement of its laws and preservation of the security of its members.

An economy has to generate sufficient wealth to replace depreciated capital (such as equipment that wears out and has to be retired) and pay for governance and security functions (law enforcement, firemen, military) that do not create wealth. Any charitable transfers to people who cannot produce themselves must be subtracted here as well. If the wealth produced by the economy after these subtractions declining, the nation as a whole cannot maintain its standard of living. This is the current situation of the United States. We have been eating the seed corn for years.

Macroeconomics is in such theoretically bad shape that no one really knows how much wealth is out there or how much we produce. Few seem to care. Traditionally, we have backed into it with measures such as Gross Domestic Product (GDP). However, GDP should really be called Gross Domestic Expenditure. We count up how much we spent and assume that roughly that much wealth has been created. As the debt-financed economy of 2001-2007 demonstrated, it ain’t necessarily so.

The Material Qualifier

All the things of the physical world, including wealth, are subject to scarcity. These rules do not apply to things of the mental world, such as human energy, human attention, affection and ideas. The mental world is ruled by plenitude.

Consider human energy. Within limits, human energy becomes increasingly available as one expends more of it. This is witnessed by the saying, “If you want something done, give it to a busy person.” The more one does, the more one is capable of doing, until one reaches some boundary limit. This can be observed in everyday life.

Repent, the End Is Near

Common sense tells us that we cannot spend our way to prosperity, but macroeconomics was born in defiance of common sense.

If something cannot go on forever, it will stop.

— Herbert Stein (1916-1999)

The use of debt to prop demand up above the level of wealth creation that cannot support it cannot go on forever. It will stop, and it will stop in a very messy manner. Long-term decisions people have made, such as career investments, will be upturned. Plans that had seemed safe and prudent for decades will be suddenly exposed as reckless and foolhardy. There will be suffering, destroyed dreams, lost years.

The idea that we live in a time of material abundance is a delusion. It is a dangerous delusion, hazardous to anyone who imbibes it. No matter how much wealth exists in a community, people will always want more. They will not become sated on necessities; they will make luxuries into necessities. Except in times of extraordinary upheaval, such as an economic contraction, demand for wealth will always outrun supply.

An industrial economy is a very complex creature, a giant with feet of clay. It can survive some incredible stresses, but smaller forces acting “with the grain” can bring it down in a way that is very difficult to undo. This was the experience of the Depression.

Macroeconomics needs a comprehensive overhaul. There is currently no recognition of the foundation of prosperity in wealth creation. The study can be changed before its advice leads the economy to slam into a wall, or wait until after, when the evidence becomes too obvious for any but the truest of believers to ignore.