Archive for the ‘Business’ Category

Victims of Financial Fraud

On 16 Feb 2024, Justice Arthur Engeron delivered his decision and order in the civil fraud trial brought by Letitia James against Donald Trump, et al., and his business entities. The decision is available for download here. It is 92 pages long, with the first six pages summarizing the decision and the last two delivering the orders of the court. The remainder discusses the facts of the case as observed by the judge.

The court found Donald Trump and the other defendants to have committed common law fraud. The court ordered Donald Trump and the other defendants to pay over $450 million, which includes disgorgement and interest thereon. The court further enjoined Trump, his sons Donald and Eric, along with co-defendants Allen Weisselberg and Jeffery McConney from serving as officers or directors of any corporation or legal entity registered in New York for several years. The order also bans Weisselberg and McConney from serving in a financial management role of a New York business entity for life.

Timely and total repayment of loans does not extinguish the harm that false statements inflict on the marketplace. Indeed, the common excuse that “everybody does it” is all the more reason to strive for honesty and transparency and to be vigilant in enforcing the rules. Here, despite the false financial statements, it is undisputed that defendants have made all required payments on time; the next group of lenders to receive bogus statements might not be so lucky. New York means business in combating business fraud.

— Decision and Order, People of the State of New York v. Donald Trump, et al., p. 4

Jeb Bush, the former governor of Florida, and Joe Lonsdale, a partner in the venture capital firm 8VC, have publicly objected to this. In a commentary published in the Wall Street Journal in February, they identify this order as one of a set of “dangerous judicial rulings.” They specifically focus on the question: since the Trump organization ultimately repaid its loans, who are the victims of this fraud?

The unusual New York law Ms. James used to investigate and sue Mr. Trump didn’t require her to prove that he had intended to defraud anyone, or even that anyone lost money. The Associated Press found that of the 12 cases brought under that law since its adoption in 1956 in which significant penalties were imposed, the case against Mr. Trump was the only instance without an alleged victim or financial loss. Bankers from Deutsche Bank, which lent money to Mr. Trump, testified that they were satisfied with having done so, given they were paid back on time and with interest. They also testified that they were uncertain whether the alleged exaggerations would have affected the terms of the loans to Mr. Trump—a key part of Ms. James’s case.

— “Elon Musk and Donald Trump Cases Imperil the Rule of Law”, WSJ, 21 Feb 2024

Actually, Justice Enegeron provided a rebuttal to that already in his order:

In its summary judgment decision, this Court already found that the SFCs from 2014-2021 were false by material amounts as a matter of law. NYSCEF Doc. 1531

— Decision and Order, People of the State of New York v. Donald Trump, et al., p. 76

Indeed, materiality under this statute is judged not by reference to reliance by or materiality to a particular victim, but rather on whether the financial statement “properly reflected the financial condition” of the person to which the statement pertains. People v Essner, 124 Misc 2d 830, 835 (Sup Ct, NY County 1984) (“there need be no ‘victim,’ ergo, reliance is neither an element of the crime nor a valid yardstick with which to test the materiality of a false statement”).

Furthermore, the supply of loanable funds is finite. All applicants are in competition for them. Therefore, I will argue the victims of financial fraud include all those who do not misrepresent their financial condition when applying for loans.

If, as Bush and Lonsdale insinuate, the misrepresentation found by the court should not be actionable because the lenders were repaid (they do not come out and make the links in their logical chain explicit), then everyone who does not misrepresent his financial condition when seeking to obtain a bank loan is a sucker who willingly disadvantages himself in the competition for loanable funds.

It is for this reason that Justice Engeron found the misrepresentation documented in the case to have been material. He writes, “The frauds found here leap off the page and shock the conscience.”

Racism, Business and Winning

I was reading through the comments in the Washington Post article “How the NFL Blocks Black Coaches“, and this comment drew my attention:

I was not aware the NFL has affirmative action buried in its mission statement. Let’s be realistic. A .500 season is not what the fans want. If so, it better be supported with an slick near-term winning plan. It matters not the color of the Head Coaches or Position Coaches. Win Baby, Win is the mantra. Also, The NFL now has no time to deal with racism. The league is in a highly funded and focused plan to build a lucrative gambling platform. NFL football is a large audience form of entertainment. Thus Amazon’s entry into the market with Thursday Night Football live steams. I suspect the company will also get a chunk if the gambling revenue too.

The part about the lucrative gambling platform is interesting; unfortunately, it is out of scope for this essay. I will say that I want no part of the sports betting action, and leave it at that.

There were several reader responses based on this logic:

- An NFL team is a species of what we discussed in microeconomics as a firm.

- Firms exist to maximize profit.

- In order to maximize profit, the management of the firm must make cold, rational decisions daily, allowing nothing to get in the way of profit maximization.

- An NFL team maximizes profit by winning games and championships.

Item 1 is, by definition, true. The rest are easily challenged by anyone with real world experience.

Plenty of businesses exist to make life comfortable for the owners or executives. They want to make just enough money to keep the lights on.

Every day, in Corporate America, management teams are making decisions for reasons other than profit maximization. As Art Klein described in Who Really Matters, organizations are run by what he called a core group, and, unless the wolf is at the door and his breathing is audible inside, the people in the core group frequently make decisions to better their own lives rather than to better the financial results of the firm.

Even if the owner of an NFL team is focused on financial results, there are many ways to achive that. For the 20 years ending with the 2021 season, the Raiders had 121 wins and 200 losses. They only made the playoffs 3 times. They moved, yet again, from Oakland to Las Vegas. Yet the team is now estimated to be worth $5.1 billion. The Raiders make $549 million on personal seat licenses; the purchaser is paying for the opportunity to pay more money to actually get a ticket to see a game. The team leads the NFL with $119 million in actual ticket revenue and has an enormous engine marketing licensed products bearing their logo. It is not necessary to have a winning record to keep this machine running.

Racism is bad for profit maximization and business effectiveness. The decision maker is deliberately reducing the candidate pool using criteria having nothing to do with the ability or demonstrated record of the applicant. It does not follow, however, that a decision maker would avoid racism simply for that reason.

There is a lot of material in the Washington Post article. I am not weighing in on the overall merit of the arguments the authors make. Read the article and consider it for yourself. I will say that I believe any commercial business that had the kind of evidence marshalled against it that the Post writers have provided would be in front of the U.S. Equal Employment Opportunity Commission.

My point here is that arguments of the form “team owners wouldn’t do that because it would be bad business” do not stand up to real-world experience.

Whatever Happened to the New Overtime Rules?

Back in 2016, President Barack Obama wielded his pen to sign a Presidential Memorandum (= executive order) to change the labor laws by which eligibility for overtime was determined. I described them in this essay.

Before the new rules went into effect, a group of plaintiffs went to federal district court and obtained a temporary injunction blocking the implementation. The lead plaintiff was the State of Nevada, whose finances were also affected by the change.

In August 2017, Judge Amos Mazzant made the temporary stay a permanent invalidation. The judge concluded that the intent of Congress was to apply eligibility for overtime based on duties, whereas the proposed rule change would change the basis to pay rate. Here is a more detailed summary of the ruling.

As I have previously discussed, I do not object to raising the pay threshold for overtime eligibility on principle. Employers should not be able to defeat the spirit of labor law through arbitrary reclassification of employees.

Nevertheless, I take the point that Judge Mazzant makes in his opinion:

As explored above, the plain meaning of the words in Section 213(a)(1) indicates Congress defined the EAP exemption with regard to duties. In other words, Congress intended for employees who perform “bona fide executive, administrative, or professional capacity” duties to be exempt from overtime pay. Congress delegated authority to the Department to not only define and delimit the EAP exemption but also to stay consistent with Congress’s intent.

The judge was true to the intent of the Constitution that Congress, not the President, is vested with the authority to make law. What should have happened is the President should have gone back to Congress for a revision of the rules. He needed the assent of Congress to revise the law to raise the importance of pay rate and reduce the importance of job duties.

Obama had a deteriorating relationship with Congress. The reason is not material; I don’t want to play “who shot John.” The point is that if the President can’t get his initiative through Congress, then constitutionally, he doesn’t get to act. It matters not how noble he believes his purpose is.

I also consider it noteworthy how I have heard absolutely nothing about this issue in the media. I found about the planned revisions at work, in an email from Human Resources. Thereafter, I followed up on my own.

Journalists spend thousands of air minutes and column-inches every day rehashing how abnormal the current President and his administration are. Even if we accept their findings, they are no longer news. Today is day 426 of the Trump presidency. The man is over 70 years old, he’s not going to change and he’s not going to adapt to standards of behavior he doesn’t accept. Get over it.

The problem here is news selection, not fake news. The fact that journalists spend so much time at the circus and so little time on issues of real life importance is not trivial. We depend on journalists to find news for us, because we have day jobs. This is an issue that affects thousands of employers and millions of workers. It should not be crowded out by the latest executive tantrum.

Follow the Trump Money

At an early age, I learned that control comes from the sources of financing. Donald Trump has had six corporation bankruptcies (note that Trump himself has never personally filed for bankruptcy), yet he retains a business empire and, unlike many other who enter government service, has refused to put his business interests at arms’ length while serving as President. From where does he obtain his financing?

Donald Trump definitely qualifies as someone who was born on third base and tells everyone he hit a triple. He not only had his father’s wealth to draw on, but his father’s relationships with lenders. His record in business is checkered, to say the least. He has a long record of disputing his bills to suppliers; even if the suppliers were delivering substandard products and services, as the Trump attorneys allege, it would suggest a problem in the selection process within the Trump organization. A less charitable — but more believable — interpretation would be that he uses his lawyers to strong-arm suppliers out of what he owes them. Now, thanks to Stormy Daniels and her lawyer Michael Avenatti, we have further insight into how Trump uses lawyers and courts as weapons against people who don’t have his resources to fight back.

Others have done the investigation for how Trump’s presidential campaign was financed. The Center for Responsive Politics has provided this summary of funding for efforts both to support and to oppose the election of Donald Trump.

The more interesting story is where his business financing is coming from. This is especially true given both his continued direct involvement in his business interests while in the White House, and his proven record of inability to distinguish his person from his office. This last is one of the most menacing aspects of his behavior in office, as it would set politics back four hundred years.

Who would lend money to an entrepreneur with six business bankruptcies under his belt? In June 2017, Francine McKenna reported that Trump has still been able been able to obtain substantial loans without facing penalizing interest premiums. Her article suggests that many lenders are supplying credit to Trump’s business, but only names Deutsche Bank and Ladder Capital, the latter of which is a real estate investment trust (REIT). In December 2017, Wendy Siegelman did some further investigation into these two organizations. Siegelman observed:

The various overlapping connections among these companies and developers is likely representative of common intersections in the finance and real-estate world. However, given the significant leverage Ladder Capital and Deutsche Bank have as holders of hundreds of millions of dollars of Trump debt, it’s important to bring these business connections and potential conflicts of interest to light.

The relationship with Deutsche Bank may present some problems. Trump has already fallen out with one arm of the bank, only to cozy up to another. For its part, Deutsche Bank has its own murky issues. In 2016, Federal regulators went after it to the tune of $14 billion for securities fraud during the 2008 mortgage crisis; the final settlement was a $7.2 billion penalty, split between fines and community service. In 2017, the bank paid $41 million to settle claims by the Federal Reserve that Deutsche Bank failed to maintain adequate controls against money laundering.

Representative Maxine Waters (D-CA) got on the trail of Deutsche Bank in late 2017, demanding that the Justice Department get moving on a investigation of the $10 million money-laundering operation that the bank is alleged to have organized. This may be the true source of Trump’s recent Twitter outbursts against Waters. Yes, Waters has her own issues, but even a stopped clock is right twice a day.

Trump has a long history of seeking business in Russia, going back before the fall of the Soviet Union. He has actively pursued business ventures in Russia. He has working relationships with Russian oligarchs. Many of these relationships are tended by son-in-law Jared Kushner, who is in way over his head. Michael Wolff, in his book Fire and Fury, quoted Steve Bannon predicting that Robert Muller would be coming after Kushner, Donald Trump, Jr., and Paul Manafort. Per Wolff, Bannon made the observation that Robert Mueller chose Andrew Weissmann, who has a reputation flipping witnesses to build cases against mobsters and white-collar criminals, as a top aide. Mueller has by now already brought charges against Manafort.

Deustche Bank could also be fertile ground for Weissman to find candidate canaries. Martin Sheil wrote this report in which he went through the various smells emanating from the bank’s closet. This two-part report is required reading for anyone who wants to understand the meat of the matter. He explained the mechanics of how the money laundering technique worked; the Russians call this action “konvert”, as in to convert subterranean assets into legitimate assets. Sheil also cited a prosecution conducted by Weissmann and Preet Bharara against an important Deutsche Bank client in 2016. Yes, that is the same Preet Bharara whom Donald Trump fired as U.S. attorney in early 2017.

Sheil also specifically identified the Mercer family, funders of Breitbart News, as deeply involved with questionable bank activities. Patriarch Robert Mercer ran a hedge fund, Renaissance Technology (RenTec), that received favored trading relationships from the bank, to the extent that the IRS has challenged them. A risk management executive whose area of responsibility included the bank’s relationship with RenTec committed suicide in January 2014. Mercer, for his part, has elsewhere been on record for claiming that the 1964 Civil Rights Act was “a major mistake.” We may not have heard the last about the Mercer family.

If, reading this, you conclude that there is nothing but innuendo here, consider this: Donald Trump ran his entire campaign on innuendo. He didn’t really mock a reporter for his disability, right? And what was that about Megyn Kelly having “blood coming out of her wherever“, if not innuendo he could walk back from? So I don’t want to hear the complaints. Live by the innuendo, die by the innuendo.

The point is that there is that there is a large potential to mine here. Robert Mueller has already subpoenaed records from Deutsche Bank. As Christopher Brennan wrote in the Daily News, money laundering requires the prosecutor to prove both that the original funds are illegal and the people involved knew that they were illegal. The latter requires more than hard records of transfers; the prosecutor needs witnesses and testimony. That is why Weissmann is there.

The question Rosemary Fanelli asked in Forbes is critical: do the Russians hold and control the debt of Donald Trump’s businesses? “Why was Trump able to borrow additional funds even after he defaulted on his prior loans? Does this mean the President is compromised and beholden to a foreign government?” Russians understand capitalism well enough to know that, when you have people by the financing, their hearts and minds will follow.

I found all these links in less than a day, sitting alone on my computer in Texas. Robert Mueller has lawyers, subpoena power and a no-limit special prosecutor credit card. What do you think he’s doing? Why do you think his investigation is taking so long?

I predict that, if the Democrats win the House this November, Trump will have Mueller fired before the end of the year. Trump has to know that a Democrat-controlled House will rain impeachment motions into the hopper, anyway. Trump will figure, “What have I got to lose?”

The Bad Family Business

I have some experience with badly run family businesses, both direct and through the stories of people I have known. My mother did not want to work for a large company when I was a teenager, so she went to work for small, owner-managed companies. As I grew up and got real-world experience, I was able to reflect upon how some of her employers qualified as bad family businesses. I can recognize some patterns. I am in a position to make a few generalizations about the bad family business.

Many privately-held small businesses feature some interesting owner behaviors. The owner often does not want to become the next GE; he just wants to be in business, set his own hours and have the business landscape his house. He has no plans to take the company public; he wants to retain control of the company, as his position confers status, power and perquisites. Thus, the behaviors of the firm you study in economics are not the behaviors of this firm, not because the owner is irrational, but because his primary goals are not market expansion or profit maximization.

The owner reasons that, without him, there would be no business, which is usually true. Therefore, in the reasoning of many owners, it logically follows that he is at liberty to impose any policies that please him, or none at all. After all, who signs your paycheck? He may decide he doesn’t have to tolerate disagreement or indulge in wasteful or unnecessary practices such as progressive discipline. If he wanted to put up with that stuff, he could work in a corporation and not have to worry about making payroll. The day he’s sick of looking at you, you can be gone. Don’t count on getting warnings like you would in a large corporation.

The bad small business does not distribute ownership of work. Micromanagement is common. If the owner thinks sentences cannot end in prepositions, no correspondence had better go out the door with a preposition on the end of a sentence. Never mind that his letters look like they were scrawled in crayon; he’s the boss, so he gets to do that. If you, his employee, do not do what he wants the way he visualizes you ought to do it, you may lose his trust forever. This will not end well for you. There is a right way, a wrong way and the boss’s way; guess which two don’t count.

The bad family business overlays a badly managed business with a governance structure heavily dependent upon members of the owner’s family. Of course, this leads to nepotism, but that is not the half of it. The family culture becomes the corporate culture. The interpersonal pathologies of the family move into the company, bag and baggage. The way the other family members deal with the owner — or don’t, as the case may be — becomes the norm for the organization. Any kind of conflict that the family can’t resolve becomes a kind of conflict the company can’t resolve. If you can’t relate to the family the way his family members relate to one another, you are not going to fit in.

Periodically, the owner of the bad family business will respond to some problem by bringing in a manager from outside. This manager will have credentials and experience that the owner believes he needs. The manager will start making changes. He will begin to have conflicts with the owner’s family members who participate in the business. He will believe that, because he was brought in to fix a problem, that he has the political clout to prevail over the family members in a conflict. Usually, the manager will be dead wrong. He will go into the owner’s office for a showdown, and come out unemployed.

It is easy to understand how these managers go wrong. They allow themselves to believe that, because the big boss complains about something, that his top priority is to get that something fixed at any cost. But when the cost reveals itself as family members losing influence, the big boss recoils. Blood is thicker than water.

The kids may not know how to build a sales force. They may not know the difference between debits and credits. They may not know all sorts of business stuff. But they know how to push Daddy’s buttons. They’re really good at that, having practiced all their lives.

On 20 January, 2017, the Executive branch of the US Government was taken over by a bad family business. It was a hostile takeover. Nobody wants to hear how things used to be done. Have you not heard? The people who did things the way they used to be done are losers. There is a new President and a new set of norms.

Donald Trump, Jr., Ivanka Trump and Jared Kushner are family. Steve Bannon found out what happens when you clash with the kids. He won a few rounds, such as with the Paris Climate Accord, but ultimately he was cut off at the knees. Now, it looks like John Kelly, the White House chief of staff, is on the road to ruin.

Sources tell the news network that Kelly believes Trump is blurring the lines between first daughter and senior adviser to the president.

Kelly has reportedly said privately that the first daughter is “playing government,” and referred to her child tax credit as “a pet project.”

— Julia Manchester, The Hill, 27 Feb [http://thehill.com/homenews/administration/375746-kelly-irked-by-ivankas-trip-to-olympics-report]

In badly run family businesses, kids get to have pet projects. You, who are outside the family circle, disparage them at your peril.

Even better: Jared Kushner received a downgrade to his security clearance, from top secret to secret [http://www.businessinsider.com/jared-kushner-bad-day-security-clearance-manipulation-2018-2].

Jarvanka, as the two are commonly known, are reported to be preparing for a “death match” with Kelly [https://www.aol.com/article/news/2018/02/28/trumps-family-is-reportedly-furious-with-john-kelly-and-the-sides-may-enter-a-death-match/23373149/]. I have seen this movie before. It does not end well for Kelly.

The employer generally gets the employees he deserves.

— J. Paul Getty

So does a President.

Overtime Sudden Death

This spring, while you weren’t looking, President Obama ordered the Department of Labor to revise the regulations governing overtime pay. Specifically, for an employee to be exempt from requirements to be paid overtime (often called an exempt employee), three tests are applied:

- Salary basis test: The employee must be paid a predetermined and fixed salary that cannot be reduced due to variations in the quality or quantity of work the employee performs. Hourly employees and workers being paid piece rates cannot be exempt.

- Salary level test: The employee must be paid at least a minimum amount specified by regulation. As of this writing, that amount is $23,660/year, last revised in 2004.

- Duties test: The employee must have duties that are primarily executive, administrative or professional.

The centerpiece of the change was a revision of the salary level test, bringing the threshold salary up to $47,446/year. These rules were to take effect on 1 Dec 2016.

I don’t have a problem with labor law in general or with revision of the salary level test in particular. I invite those readers who disagree to read a special section of this post I have included at the end to discuss the history of labor law.

It would have been better to have a multi-year incremental ramp. Businesspeople can handle predictable change much better than sudden change.

However, there was a significant process problem. Obama clearly believed that he could not obtain the consent of Congress. Being of superior intellect and wrapped in righteousness, Obama went ahead and issued a Presidential Memorandum — basically an executive order — directing the Department of Labor to go forward with the changes.

Obama may well have been right in his supposition. It’s irrelevant, because Congress is the entity empowered by the Constitution to make law. Consider, by way of analogy, if I were to say, “I would have asked you for money to feed the homeless children, but I knew you would never agree. So I took one of your checks and forged your signature.” Whatever my supposedly higher purpose would have been, my action would still not be acceptable.

Since those opposing the changes did not get the opportunity to have their views represented in Congress, they went to court. This week, a federal judge in Texas issued a nationwide injunction blocking implementation of the new rules. In his ruling, the judge found that the Department of Labor exceeded its authority under existing law and ignored the intent of Congress.

I find it particularly noteworthy that the primary plaintiff in the case is the State of Nevada, itself a government entity. The case raises challenges to the ability of the federal government to restrict the employment practices of state governments on Tenth Amendment grounds, although the judge did not accept this reasoning.

The proposed changes also include a mechanism to automatically update the salary level threshold every three years based on statistical data. The court found that there was no provision in existing law to implement this. Therefore, absent the expression of the will of Congress, the Executive exceeded its authority.

This decision is only a stay; the final fate of the change in law remains to be decided. However, one of the tests that the court applied was: Does the plaintiffs case have substantial likelihood of success on its merits? The court found that it did.

Special Bonus Media Question

This issue first arose in May 2016, when Obama issued his Presidential Memorandum. How much have you heard about this, before or after the court decision of this week, from the media outlets you frequent?

The Origins of Labor Law

One hundred years ago, there were few labor laws. Employers enjoyed concentrated negotiating power and could dictate almost any terms. There were widespread abuses, including:

- Failure to pay employees on time;

- Payment of wages in company scrip, which could either be redeemed at the company store for goods at arbitrary prices or exchanged at a discount for currency;

- Implementation of arbitrary deductions from pay;

- Failure to disclose deductions from pay.

“Well, if you don’t like it, don’t work for that employer.” This is a shallow and cavalier brush-off that ignores the disparity in bargaining power.

The Anglo-American legal tradition has not accepted such a principle. Here is an illustrative case in black-letter law. A railroad required its employees to sign contracts relieving the railroad of responsibility for the negligence of other employees (as the organization itself acts through the agency of employees, including managers and executives). The state supreme court rejected the notion that the employer could escape from responsibility in this manner:

And it may be questionable whether it is in their power to denude themselves of such responsibility by a stipulation in advance. But we prefer to rest our decision upon the broader ground .of considerations of public policy. The law requires the master to furnish his servant with a reasonably safe place to work in, and with sound and suitable tools and appliances to do his work. If he can supply an unsafe machine, or defective instruments, and then excuse himself against the consequences of his own negligence by the terms of his contract with his servant, he is enabled to evade a most salutary rule.

In the English case above cited it is said this is not against public policy, because it does not affect all society, but only the interest of the employed. But surely the state has an interest in the lives and limbs of all its citizens. Laborers for hire constitute a numerous and meritorious class in every community. And it is for the welfare of society that their employers shall not be permitted, under the guise of enforcing contract rights, to abdicate their duties to them. The consequence would be that every railroad company and every owner of a factory, mill or mine, would make it a condition, precedent to the employment of labor, that the laborer should release all right of action for injuries sustained in the course of the service, whether by the employer’s negligence or otherwise. The natural tendency of this would be to relax the employer’s carefulness in those matters of which he has the ordering and control, such as the supplying of machinery and materials, and thus increase the perils of occupations which are hazardous, even when well managed. And the final outcome would be to fill the country with disabled men and paupers, whose support would become a charge upon the counties or upon public charity.

— Little Rock & Fort Smith Ry. Co. v. Eubanks, 3 S.W. 808 (1886).

The spirit of this ruling cannot be ascribed to progressivism, as it predates progressivism. It was written in a time when judges were unwilling to rewrite the law. It stands as a historical marker, attesting that our legal tradition has never accepted an interpretation of laissez-faire that grants market participants with concentrated negotiating power free rein to impose whatever terms they choose on market participants with diffuse negotiating power.

Labor law originated in response to real abuses in the employment market. Abuses still occur, even with the laws in place. For example, I recall a software company in the nineties that would put salaried employees on a 36-hour week every time the owner got in a cash flow bind. That is not how being salaried is supposed to work. The employees may have made a calculated decision that enduring this was better than being laid off, but it is not OK. Tolerating this puts the competitor, who may also be in a cash flow bind, under unwarranted pressure to do likewise.

It is obvious to anyone giving this a moment’s though that employers can and do classify employees as salaried in the expectation that they will be working at least forty hours a week and that the employers wish to avoid paying overtime to these employees by making this classification. It is reasonable for the law to implement defenses to such reclassification practices, which are simply to evade compliance.

Sarbanes-Oxley: Ideas Are Not Laws

The Sarbanes-Oxley Act of 2002 was and still is a contentious piece of legislation. Comments are still flying insinuating that the law is an unwarranted intrusion into the private sector and has negative consequences for the economy as a whole. I do not agree with this claim.

The act is also an excellent case study into how government does not operate on constitutional principles and the problems that arise from this fact. It works well in this role because the law is relatively brief and comprehensible — as acts of Congress go — and because so many ordinary people have had to live with the consequences.

Let’s peel it apart and see what the issues are.

The Law

The text of the law can be found here: https://www.congress.gov/bill/107th-congress/house-bill/3763. It is only 66 pages long, and not nearly as difficult to comprehend as the Patient Protection and Affordable Care Act of 2010.

The act, commonly referred to in industry as Sarbox or SOX, is divided into eleven major sections, or Titles:

TITLE I—PUBLIC COMPANY ACCOUNTING OVERSIGHT BOARD

TITLE II—AUDITOR INDEPENDENCE

TITLE III—CORPORATE RESPONSIBILITY

TITLE IV—ENHANCED FINANCIAL DISCLOSURES

TITLE V—ANALYST CONFLICTS OF INTEREST

TITLE VI—COMMISSION RESOURCES AND AUTHORITY

TITLE VII—STUDIES AND REPORTS

TITLE VIII—CORPORATE AND CRIMINAL FRAUD ACCOUNTABILITY

TITLE IX—WHITE-COLLAR CRIME PENALTY ENHANCEMENTS

TITLE X—CORPORATE TAX RETURNS

TITLE XI—CORPORATE FRAUD AND ACCOUNTABILITY

Much of the law addresses problems commonly found in business at the time of the legislation. For example, Title II addressed the practice of consulting firms to offer audit services essentially as a loss leader to get the ear of executives so they could sell computer software selection, systems implementation and other management services. Once such relationships were in place, the notion of auditor independence was out the window; a dissatisfied audit client could hit back by reducing purchases of non-audit services from the consultants. The GAO had been pushing for changes in this area for years. As a result, all the audit firms who had not already spun off their management and IT consulting businesses were forced to do so.

Most of the complaints about the act arise from Title IV. For example, Section 402 prohibits publicly traded companies from making personal loans to their officers, a common practice prior to 2002. If you want to have a company that you can use as a personal piggy bank, don’t take the company public. Then it’s between you and your other private investors (if any) how you run it. However, it is bad public policy to allow these practices in a publicly traded company.

The most problematic part of the law was Section 404. Here it is, in its full glory:

SEC. 404. MANAGEMENT ASSESSMENT OF INTERNAL CONTROLS.

(a) RULES REQUIRED.—The Commission shall prescribe rules requiring each annual report required by section 13(a) or 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m or 78o(d)) to contain an internal control report, which shall—

(1) state the responsibility of management for establishing and maintaining an adequate internal control structure and procedures for financial reporting; and (2) contain an assessment, as of the end of the most recent fiscal year of the issuer, of the effectiveness of the internal control structure and procedures of the issuer for financial reporting.

(b) INTERNAL CONTROL EVALUATION AND REPORTING.—With respect to the internal control assessment required by subsection (a), each registered public accounting firm that prepares or issues the audit report for the issuer shall attest to, and report on, the assessment made by the management of the issuer. An attestation made under this subsection shall be made in accordance with standards for attestation engagements issued or adopted by the Board. Any such attestation shall not be the subject of a separate engagement

That’s it. The officers of the company have to attest that they have adequate internal controls and, as described in Section 302, they have to sign the report. Here is Section 302 in its entirety:

SEC. 302. CORPORATE RESPONSIBILITY FOR FINANCIAL REPORTS.

(a) REGULATIONS REQUIRED.—The Commission shall, by rule, require, for each company filing periodic reports under section 13(a) or 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m, 78o(d)), that the principal executive officer or officers and the principal financial officer or officers, or persons performing similar functions, certify in each annual or quarterly report filed or submitted under either such section of such Act that—

(1) the signing officer has reviewed the report;

(2) based on the officer’s knowledge, the report does not contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements made, in light of the circumstances under which such statements were made, not misleading;

(3) based on such officer’s knowledge, the financial statements, and other financial information included in the report, fairly present in all material respects the financial condition and results of operations of the issuer as of, and for, the periods presented in the report;

(4) the signing officers—

(A) are responsible for establishing and maintaining internal controls;

(B) have designed such internal controls to ensure that material information relating to the issuer and its consolidated subsidiaries is made known to such officers by others within those entities, particularly during the period in which the periodic reports are being prepared;

(C) have evaluated the effectiveness of the issuer’s internal controls as of a date within 90 days prior to the report; and

(D) have presented in the report their conclusions about the effectiveness of their internal controls based on their evaluation as of that date;

(5) the signing officers have disclosed to the issuer’s auditors and the audit committee of the board of directors (or persons fulfilling the equivalent function)—

(A) all significant deficiencies in the design or operation of internal controls which could adversely affect the issuer’s ability to record, process, summarize, and report financial data and have identified for the issuer’s auditors any material weaknesses in internal controls; and

(B) any fraud, whether or not material, that involves management or other employees who have a significant role in the issuer’s internal controls; and

(6) the signing officers have indicated in the report whether or not there were significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of their evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

(b) FOREIGN REINCORPORATIONS HAVE NO EFFECT.—Nothing in this section 302 shall be interpreted or applied in any way to allow any issuer to lessen the legal force of the statement required under this section 302, by an issuer having reincorporated or having engaged in any other transaction that resulted in the transfer of the corporate domicile or offices of the issuer from inside the United States to outside of the United States.

(c) DEADLINE.—The rules required by subsection (a) shall be effective not later than 30 days after the date of enactment of this Act.

It’s a little longer, and it’s not entertaining reading, but it is not incomprehensible, either. And there is some dry humor here: anyone who has ever worked in a publicly traded company would find it comical to think of an executive team cheerfully reporting, “Yeah, we have these known deficiencies in our internal controls” to the shareholders.

Congress acted to address real problems. Every time there was any accounting irregularity at a publicly traded firm, the executives would claim no knowledge of it, seeking low-level employees and managers to blame. At the same time, executive compensation was spiraling upward and justified by the claim that companies needed the best talent available. There are plenty of people who are good at evading responsibility; there is no need for a bidding war to find talent like that.

However, there is a substantial problem with the law as written: what, legally, is an internal control structure? By what criteria does one judge its adequacy? Sarbox is mute on this subject. So how do you know whether or not you are out of compliance with the law?

Chaos Reigns

For five years, the business world was plunged into a compliance crisis. Are my financial controls adequate? How do I tell? How would I substantiate it in court if I had to?

The law became the Sarbanes-Oxley Full Employment for Management Consultants Act. An entire industry sprang up for devising controls that might be adequate. Examples of the extent to which people went include:

- An instance where the company required the CFO to personally hand every employee their payroll check;

- An instance where auditors found the company out of compliance because a salesperson spent $15 for donuts for a meeting and was not required to have two authorizing signatures on the reimbursement;

- An instance where auditors required the company, as part of Sarbox compliance, to take pictures of a smoke detector and retain receipts for the batteries.

[source]

Further, the newborn audit industry put great weight on separation of duties, which focuses on the risk of low-level misbehavior. As Solomon and Peecher observed in a 2004 Wall Street Journal article:

Billions are being spent documenting controls that lie below, and can be stealthily overridden by, C-suite members.

— “SOX 404 — A Billion Here, a Billion There …”, WSJ, 9 Nov 2004.

There was a general tendency to demonstrate compliance by volume instead of weight. Elaborate charts and documents were generated to show the abundance of controls, whether or not they provided meaningful reduction of risk.

The real danger was that a class-action suit would assert that shareholders were defrauded by a company having inadequate controls, and then a judge would be determining what adequacy was.

Meanwhile, everyone who wanted to avoid change now had an evergreen excuse to do so: “We can’t do that because of Sarbanes-Oxley.” In 2006, my responsibilities included changing business processes. I finally downloaded the legislation on to my laptop and, when confronted with this excuse, would invite the person to look at the law and show me where it says the existing process has to be the way it was to maintain compliance. Disingenuous, to be sure; but so was the excuse I was given. This is the real hidden economic cost of Sarbox: compliance as a justification for inertia.

The PCAOB

Title I of the Act created the Public Company Accounting Oversight Board (PCAOB) to supervise the audit practices of publicly traded companies and set standards. Although its actions have the force of law, Section 102 explicitly states:

(b) STATUS.—The Board shall not be an agency or establishment of the United States Government, and, except as otherwise provided in this Act, shall be subject to, and have all the powers conferred upon a nonprofit corporation by, the District of Columbia Nonprofit Corporation Act. No member or person employed by, or agent for, the Board shall be deemed to be an officer or employee of or agent for the Federal Government by reason of such service.

The Act made the PCAOB answerable to the Securities and Exchange Commission, which is an independent agency of the federal government. The SEC must approve PCAOB rules and standards.

In July 2007 the PCAOB produced Auditing Standard No. 5: An Audit of Internal Control Over Financial Reporting That Is Integrated with An Audit of Financial Statements, which formally provided for:

- Risk-driven determination of control adequacy;

- Scaling of the audit relative to the size of the business being audited.

Nevertheless, the guidance primarily addresses the process of auditing the controls, rather than control structure adequacy.

The constitutionality of the PCAOB was itself challenged. Within Section 101, this paragraph provides the SEC with exclusive supervision over board members:

(6) REMOVAL FROM OFFICE.—A member of the Board may be removed by the Commission from office, in accordance with section 107(d)(3), for good cause shown before the expiration of the term of that member.

This places the board members outside the supervision of either Congress or the President. The challenge maintained that the PCOAB violated separation of powers, and further that the board members should have been working for the Government since they were executing the law. The challengers sought an injunction blocking the board from exercising the authority described in Title I. In 2010, in the decision Free Enterprise Fund and Beckstead and Watts, LLP v. Public Company Accounting Oversight Board, et al. (561 U.S. 477), the Supreme Court found that the structure did violate separation of powers, but simply severed the clause from the remainder of the Act, which the Court upheld.

Management Controls

Managers exist to plan, organize, staff, direct and control. Management controls are the tools available to you as a manager so that you can know what is going on when your back is turned.

Here are some common examples of management controls:

- An expense report;

- A purchase order;

- A work order in a factory;

- A second signature line on a check;

- A budget;

- A schedule;

- A project review meeting;

- A status report;

- Paid vacation with a requirement that it be used every year (Do you see why? If not, think about check kiting: you can’t go on vacation if you’re kiting checks.).

Many managers are not good at devising and implementing controls. If you have any significant work experience, think about all the false starts and big splashes that you have seen, which fizzled out in weeks when upper management turned their attention to the next emergency or big idea. What happened? Almost always, a plan is launched with no controls. Once the sponsors were not paying full attention, the entire initiative falls by the wayside.

Controls have costs, and can be applied excessively. You may have seen checks requiring a countersignature only where the amount exceeds a threshold level. The risk of abuse below that level is not worth the additional time and energy to obtain a second signature. This is why the earlier cited requirement to get two signatures on a reimbursement for $15 of donuts is ridiculous.

Typically, as a company grows, controls have to be put in place, and these harden into policies. Then you encounter people who think policy is God and have no understanding of why the policy came about, enforcing minutiae while failing to understand intent. Eventually the company chokes on red tape, and the policies have to be relaxed. Then, the next time financial results go down or a compliance crisis occurs (such as provoked by this legislation), a new set of policies is thrown together. And so on, and so forth, and scooby doobie doobie.

So if the members of Congress and their staff aides thought that “adequate internal control structure” was a well-understood norm in the private sector that needed no definition, they had another think coming.

Lawmaking

Throughout Anglo-American history, people strove to replace rule of man with rule of law. Rule of man could be arbitrary and capricious; rule of law is systematic, comprehensible and predictable. Under rule of law, the citizen can know what actions would be contrary to the law and avoid these actions.

The Constitution considers Congress the premier branch of government, not the President (you’d never know that from watching TV news). Article I is half of the original Constitution. The Constitution forbids Congress from taxing the exports of a state to another, granting titles of nobility or passing bills of attainder. The Constitution provides Congress with the authority to coin money, raise and support armies and make laws.

The law works best when there are lists of requirements that you can check off. For example, to have a contract, there must be lawful subject matter, parties with capacity to commit to a contract, offer, acceptance and consideration to both sides. If any of these elements are not present, there is no contract. The law then defines the elements: what constitutes adequate capacity to enter into a contract, what is and what is not acceptance, what is and what is not consideration. The issues can get complicated because people are complicated; it is possible to apply the law to the facts and figure out whether or not you are in a contractual relationship.

The citizen has to be able to comprehend the law and its application to the her actions in order to be law-abiding. Judges love to say, “Ignorance of the law is no excuse.” But you can read Sarbox from front to back and still have no idea what would be an adequate internal control structure, and thus in compliance with the law. It is not possible to apply Sarbox to your facts and figure out whether or not you have adequate internal controls.

Delegation

.. [T]he Supreme Court created modern jurisprudence by giving full faith and credit to any expression that could get a majority vote in Congress. The Court’s rule must once again become one of declaring invalid and unconstitutional any delegation of power to an administrative agency or to the president that is not accompanied by clear standards of implementation.

— Theodore Lowi, The End of Liberalism (2nd Ed.), 1979, p. 300.

The Constitution visualized Congress as a the lawmaking power within the government, Congress being the branch of government most accountable to the people (and to the states, but that is another topic for another day). The president is the executive and exists to execute the will of Congress. There was no provision for administrative agencies effectively accountable to no one.

The last time the Supreme Court took non-delegation seriously was 1935. In A. L. A. Schechter Poultry Corporation, et al. v. United States (295 U.S. 495), the Court found that the National Industrial Recovery Act contained an unconstitutional delegation of congressional law-making power to the executive.

President Roosevelt’s response was to threaten to seek congressional approval to expand the Supreme Court by six additional justices. Roosevelt abandoned this “court-packing” proposal after one justice shifted his position on rulings in 1937 to be more favorable to Roosevelt — the “switch in time that saved nine” — while another justice who was consistently opposed to New Deal legislation retired. Since then, the Court has been unwilling to uphold non-delegation.

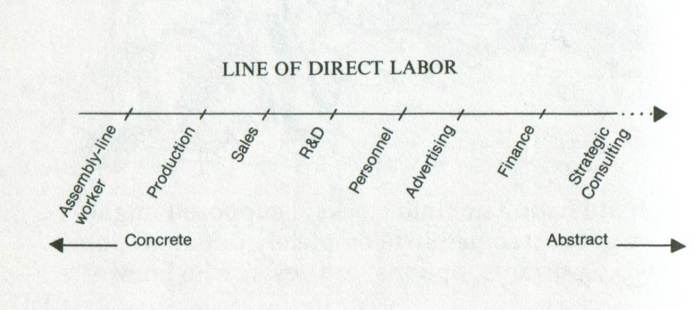

Lowi shows how the rule of law has been abandoned as public controls have shifted:

- from concrete and specific to abstract and general;

- from rule-bound to discretionary;

- from proscriptive through prescriptive to comprehensive (Lowi calls this last categoric).

Under present conditions, when Congress delegates without a shred of guidance, the courts usually end up rewriting many of the statutes in the course of construction. Since the Court’s present procedure is always to find an acceptable meaning of a statute in order to avoid invalidating it, the Court is constantly legislating. In contrast, a blanket invalidation under the Schechter rule is tantamount to a court order for Congress to do its own work.

— Lowi, p. 300.

The Constitution visualized Congress as the lawmaking body and accountable to the people. The Constitution, augmented by John Marshall, did not visualize courts as accountable to the people, but neither did the Constitution grant courts the power to make law. No one visualized a private non-government entity reporting to an independent federal agency where the private entity could make pronouncements with the force of law.

For rule of law to exist, it is necessary that the government is rule-bound. Laws must have clear definitions of the behavior to be avoided. Complex issues will arise that will cause the public to have a sense that something is going on that is improper, unfair or downright wrong. However, the starting point is that behavior is allowed unless ruled otherwise. If Congress cannot spell out what the unlawful behavior is, there should be no law.

The Bottom Line

The Sarbanes-Oxley Act offers a tour through important issues that are fundamentally wrong with lawmaking today:

- Congress passed what was described as a law, but was really, in the instance of Section 404, a sentiment.

- There were no factual definitions of the proscribed behavior.

- The citizen could not know whether or not he was in compliance with the law.

- Congress made a full-toss delegation of the definition of the details of the law to a non-governmental entity (PCAOB) working for a constructively autonomous federal agency (SEC).

- Citizens had to wait years to have key aspects of the law operationalized and when that was provided, it was not provided by Congress.

- Confronted with a constitutional challenge to the law, the Court granted itself a line-item veto to rewrite the law.

- No one who operationalizes the law is politically accountable to the citizens for his actions.

It serves as an example of these issues that is comprehensible by those of us who have had to live with the effects of the law.

So Microsoft Is Like General Motors

An article was brought to my attention today discussing the Pontiac Aztek, the ugliest car to come out of Detroit since AMC went down for the third time. Y’know, come to think of it, …

What is worth considering from this disaster is how it came about.

These things require a culture of complete acquiescence and intimidation, led by a strong dictatorial individual who wants it that way.

— “How Bad Cars Happen: The Pontiac Aztek Debacle”, Road and Track, http://www.roadandtrack.com/voices/columnists/bob-lutz/bob-lutz-tells-the-inside-story-of-the-pontiac-aztek-debacle

People tend to read that sentence and think that the dictatorial individual drives the culture. Originally that is the seed, but at some point the culture becomes self-perpetuating. It seeks out dictatorial individuals and legitimizes their bullying behavior. The culture develops its own self-preservation, and will spit out anyone who doesn’t conform. Robert Ringer described the process back in the seventies:

I’m Crazy/You’re Sane Theory: If you attempt to carry on a relationship with an irrational person, given enough time they will make you feel like you’re the neurotic one.

Ordinary, apparently rational people who want to do the right thing are ingested by the culture and either beaten into conformity or spit out. Often, they are beaten into conformity, sucked dry and then spit out. I watched one company litter the Chicago metro area with its human casualties over four years.

Culture eats strategy for breakfast.

— attributed to Peter Drucker

Sometimes a board of directors will be motivated to bring in a completely different CEO to introduce change in the company. It never works, because they underestimate the strength of the culture — often, they are in denial about it, having spent more time reading their own press releases and glossyware than actually rubbing elbows with real people engaged in real business within the company. The CEO arrives with great fanfare, brave-new-world speeches and the best of intentions. It lasts about a year, and everyone knew it would. One person who had been in such a leadership position said in an interview, “They will wait you out and wear you out.”

Lest people think this only occurs in old companies that are relics from a bygone era, we have the example of Microsoft. The company has recently produced two highly visible and entirely avoidable product fiascos: Windows Phone and Windows 8.

When did I ask for an improved desktop? I was getting my work done just fine with the desktop I had.

Why do I want my desktop to look like a smartphone? I am not sitting in the car waiting for my kids to come out of sports practice — I am trying to get my work done. A phone is a content consumption device. My desktop computer is a content creation device. My job is to create content: documents, spreadsheets and the occasional presentation. There is an impedance mismatch between what I have to do and this interface that makes my productivity tool look like an amusement.

Can I come to your office, rearrange your desk to suit my artistic sensibilities and then tell you how stupid you are when you can’t find anything?

People within Microsoft tried to tell the people who were responsible for the decision to remake the Windows user experience that these changes would not go over. The people who were in charge of the product didn’t listen. So the Windows team took their show on the road and got what they got.

One objection to the internal advice not to remake the interface was that the people given the advice did not have data to back up their statements. Well, duh — it hadn’t been released yet. Now you’ve got all kinds of data from the failure of the product to be accepted. The people making the changes didn’t have data, either. They did it because they wanted to. That is a salient feature of Microsoft culture: I will do what I want to do because I am brilliant; if you want to argue with me, you have to have data.

Back in 2009, when the Windows Mobile 6 phone was still carrying the flag, there were a substantial number of Microsoft employees carrying competitor phones. To get a sense of the significance of this, consider that Microsoft does an employee satisfaction survey every year and gets response rates above 80%. The Microsoft employee population is generally enthusiastic about the Microsoft product line, usually likes the products and wants them to succeed. So if the employees themselves — who are also shareholders, by the way — are spending their own money on competitor phone products, is there not something to learn from them?

Nothing doing. It is disloyalty, pure and simple. You work for Microsoft, and you owe it to us to get behind our product, no matter what.

[Former CEO Steve Ballmer’s] passion can tip over into what a former executive calls “religious zealotry.” Challenge was betrayal. “His view was that anyone in the company who used the iPhone was a traitor,” says this person.

— “The Empire Reboots”, Vanity Fair, http://www.vanityfair.com/business/2014/11/satya-nadella-bill-gates-steve-ballmer-Microsoft

Vanity Fair is all about people with high social wattage, and tends naturally to fix their focus on the top of the pyramid. And, to be sure, it is true that the fish rots from the head. Ballmer had a reputation within the company for stomping on employee’s iPhones in meetings. Ballmer helped shape the culture in his image. Bill Gates did so even more; without Gates, Ballmer would be some unheard-of middle manager retiring from P&G.

Nevertheless, the people who were in charge of the phone effort could have taken the responsibility to approach employees and say, “I see you have someone else’s phone. What did it offer that ours doesn’t?” In consumer products, real feedback is hard to get. The employees would have been happy to provide it in a constructive manner. There were no takers.

The cost of this arrogance? Microsoft lost time they can never get back.

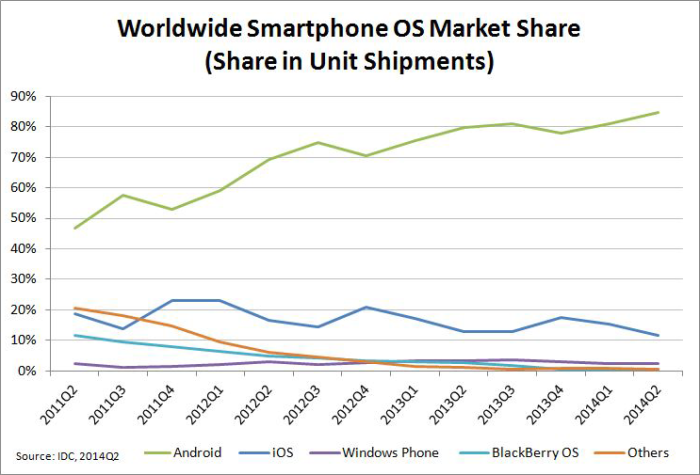

Apps have a role in phone operating system (OS) acceptance. Thus a chicken-and-egg scenario develops when app developers look at charts like this to select the technologies in which they will invest. Without consumer acceptance, you don’t get apps. And without apps, you don’t get consumer acceptance. The rich get richer, and the poor get marginalized.

There is probably room for two smartphone OS products in the consumer market. Right now, it looks like those two will be Android and iOS.

When I read the article by Bob Lutz on GM culture, it reads all too familiar:

Early on, the Aztek obviously failed the market research. But in those days, GM went ahead with quite a few vehicles that failed product clinics. The Aztek didn’t just fail — it scored dead last. Rock bottom. Respondents said, “Can they possibly be serious with this thing? I wouldn’t take it as a gift.” And the GM machine was in such denial that it rejected the research and just said, “What do those a**holes know?”

— “How Bad Cars Happen: The Pontiac Aztek Debacle”

It’s not surprising that Microsoft didn’t bring in an outsider to replace Steve Ballmer. They don’t think they have a cultural problem. They think they just need some tweaks around the edges. They have $60 billion in topline revenue. Prior to joining Microsoft, I had never worked at a company with a $600 million topline.

And what would someone from the outside do? How would one bring cultural change to an organization that likes its culture just fine and has no objective imperative to change it?

So it is hardly surprising that the new CEO, Satya Nadella, put his foot in his mouth at a conference to promote careers for women in computing in October. This served as a launching pad for a wider discussion of women in the software business.

I had a woman at a technology company who, when she saw the science, just blurted out, “I thought there was something wrong with me! I hired a coach and for three years he’s been trying to help me fit into the team here, because I thought I needed fixing, and now I see that I’m just wired differently.” I asked the women in the audience, “How many of you can relate to that?” And every single hand went up.

— “Why the Tech Sector Struggles to Close the Gender Gap”, http://www.nbcnews.com/feature/maria-shriver/why-tech-sector-struggles-close-gender-gap-n193711

Yes, the differences between genders are an element at work, but so are other differences. Culture is the main driver. When you don’t match the culture, the culture expects you to adapt to it. It is your problem and you have to fix it. I’m crazy; you’re sane.

Microsoft doesn’t have merely a male culture; Microsoft has an adolescent boy culture. I’m smarter than you; I pwn you.

Don’t believe me? Open up your solitaire game, make a few moves and then hit F2 to start a new game. You will be greeted with this dialog:

Look at the helpful advice: This counts as a loss in your statistics.

When I play solitaire with a deck of cards, I don’t have statistics. If I don’t like the way the game is going, I can just deal another one. Why do I need statistics?

But at Microsoft, it would be simply unthinkable not to keep statistics. How else can I compare my performance to that of others? I have a 90% record, while you only have an 80% record. You’ve been pwned.

And yes, I am smart enough to go into the registry, find where Solitaire keeps the statistics and change them. I have also lived long enough to have heard the expression, “Even if you win the rat race, you’re still a rat.”

A lot of women look at this culture and think, “I’m capable of making it here, but yuck! Why bother?” Plenty of men do, also.

PS: I should point out that when I came back after publishing this article to make a correction, my system bluescreened. Evil Empire indeed.

Evolution of the Workplace, 1960-2015

Let me take you back to a time before we had euphemisms like downsizing, rightsizing and midlife career re-evaluation. Before there were cubicles. Do you think everyone had a private office at work? Think again; the typical office looked like this:

This was a time, compared to today, where labor was cheap and capital was dear. There were large numbers of people being employed, and getting green money to spend outside the company on equipment, even if the equipment existed, was like getting blood out of a stone. So labor was often substituted for capital, performing laborious tasks that could have been automated. What’s the problem? We’re paying you, aren’t we?

Capital-Centric Work Processes

Most management teams saw as their purpose to optimize existing processes, not to challenge them or blow them up. Change came slowly and in measured increments.

Capital was the bottleneck resource, and most of the capital was in plant and equipment. Raw materials and people were cheap. Therefore, the needs of the plant and equipment came first. That milling machine takes time to set up for any particular job. Therefore, you want to amortize that setup time over as many parts as you can. You determined an optimum lot size and produced that number of pieces on a work order. There were exceptions, such as the job-oriented machine shop, but they by their very nature could not realize the economies of scale that mass production offered and depended upon. Machine shops were niche players in the mass production economy.

What do you do with all those parts and subassemblies? You store them in a parts room, and staff the parts room with people to watch over them, catalog them and only distribute them to other people with appropriate pieces of paper called work orders in their hands.

Parts clerks could make a decent living, especially considering the fact that they had to have only a minimum level of clerical skills and had no pressure to produce. Some people bought homes and raised families on the money they make working in the parts crib.A work order is more than just a set of instructions; it is an authorization to produce. It says that an operator should producing these parts at this time, not some other parts. It provides authorization to draw parts from the parts crib. It contains standards for productivity and scrap rates, against which the worker will be compared.

This whole dance was kept moving without the aid of computers by another small squad of people in the inventory control office. Many of them had jobs that were also clerical in nature, such as matching completed orders with receipts for materials used. Much of it was mind-numbing work. But what’s your problem, you’re getting paid, right?

At this time, it is worth reviewing the assumptions that underpin business in this era:

- Labor is cheaper than capital.

- Labor is more flexible than capital.

- People come to work to do the least work for the most money. If you don’t have tight controls,

- the majority will be goofing off;

- the enterprising ones will be doing their own work on your equipment or converting your inventory into scrap that they can sell on the side.

- Most people aren’t capable of brain work. They need follow-the-horsie procedures to guide them through their working day. After all, that is what the education establishment was telling us at the time.

- We have the know-how and the processes. We won the war, didn’t we? Our focus needs to be on operating and optimizing.

- Key success factors for the employee are punctuality, following the rules and ability to get along with others. A highly talented person who can’t be counted on to show up on time and follow rules is useless; replacing such a person with a plodder who is punctual and takes direction well is an improvement.

- Business relationships are basically adversarial in nature:

- Suppliers want to charge as much as they can, whereas customers want to pay as little as they can;

- Management wants more work for less money, whereas labor wants less work for more money.

- In the supply chain, the company with the access to capital has the upper hand and calls the shots. That is usually the manufacturer.

- The United States is the only market that matters. Everyone else is trying to crawl back into the industrial age after World War II.

- People all want basically the same things. Therefore, the best mass producer can obtain the greatest market share, the lowest unit costs and the best returns on investment.

- Despite the marketing fluff, we are basically trending toward perfect competition, producing commodity products that are differentiated by price and availability.

- Low cost through economies of scale wins.

Mass man must be served by mass means.

— Roger Price, The Great Roob Revolution, 1970.

David Frum called pre-1970 America a “love-it-or-leave-it” society:

You didn’t like Chervolets? Tough. Your kid was home sick and wanted to watch cartoons at ten on a weekday morning? Also tough. You wanted a checking account that paid interest? Again tough. You needed to pay less than $900 for an economy ticket to Paris? Tough once more.

— David Frum, How We Got Here — The 70’s: The Decade That Brought You Modern Life (for Better or Worse).

And I would add:

- You’re a woman with kids who has run away from your abusive marriage and has to make a go of it on your own? Tough.

- You grew up working-class and were put off by the process of college application, but now you don’t like your factory floor job? Tough.

- You are completely unchallenged by your job and have all you can do to get through the working day? Welcome to the club. You’re getting paid, right? (spot a theme here?)

- You have a better idea for a car you would like to produce? Stop doing that, Mr. Tucker. You’re going to disrupt the whole industry, screw up the future sales everyone is counting on and cause people to lose their jobs. We don’t want you doing that and we won’t allow it.

Knowledge Work

Knowledge work has existed for a long time, although Peter Drucker is generally credited with coining the term in his 1959 book Landmarks of Tomorrow. Here are some jobs that have been focused on knowledge work since time out of mind:

- Military officer

- Lawyer

- Surgeon

- Missionary

- Actor

The movie business is the only business in the world where the assets go home at night.

— attributed to Dorothy Parker

What distinguishes knowledge work from other kinds of work?

- It is non-routine in nature, and therefore does not readily lend itself to standardization and optimization;

- Being non-routine, the unique conditions of the instance of work being performed influence what is done, how it is done and how long it takes;

- The person doing the work knows more about the conditions of the work than the manager or outside expert;

- The knowledge worker applies personal knowledge to the work in a way that other works do not.

On the last point, compare a software engineer to a class A machinist. Both have some elements in common:

- Both are highly skilled occupations;

- Both require thinking;

- For both, one would expect experience to matter.

However, there is a skill definition for a class A machinist that practitioners recognize. Two persons both having that skill level expect to be paid comparable wages. In that sense, class A machinists are fungible.

Software engineers, by contrast, are much more varied and less fungible. When an experienced software developer leaves, it is much less easy to go get another one of similar background and plug them into the role.

You might argue that you have known people who call themselves software engineers but who are completely lost when confronted with problems outside of a small range with which they expect to solve. I would take your point; such people are not really engineers at all, but technicians. This illustrates another issue with knowledge workers; it becomes increasingly difficult to identify abilities in the traditional means available to the hiring manager.

When I was hiring, recruiters used to ask me how many years of experience I wanted in the candidates. It’s not a useful question. I can have two candidates, each of whom has six years’ professional experience:

- Amy has six years of progressive and varied experience. She has constantly sought to expand her scope and taken initiative to resolve a greater variety of problems in the course of delivering results.

- Bob has six years of experience. But after the first two years, he got into a comfortable routine where he can repeat the same methods over and over, at which point he allowed himself to stop growing. Bob really has two years of experience three times over.

Since 1980, for reasons I shall explore, a greater share of work in general has become knowledge work. This has caused dislocation for persons:

- Who are not adequately prepared to do knowledge work;

- Who don’t want to do knowledge work;

- Who never had to do knowledge work and found themselves suddenly facing changed conditions.

Pulling the Rug Out

People tend to want to learn the ground rules and operate within them. When the assumptions on which people make long-term decisions and investments suddenly change, there is no alert that comes in the mail notifying them that they need to reconsider their life strategies. Yet if one continues on a path for which the underlying assumptions are no longer valid, one will not arrive at a happy ending.

What happened to the assumptions underpinning the American workplace since 1980?

| Old Assumption | New Reality |

|---|---|

| The United States is the only market that matters. Everyone else is trying to crawl back into the industrial age after World War II. | Now other nations have climbed back into the modern world with a vengeance, with current skills and up-to-date equipment. They are lean and mean, while many people here are comfortable and uncompetitive. |

| People all want basically the same things. Therefore, the best mass producer can obtain the greatest market share, the lowest unit costs and the best returns on investment. | Once people had their basic needs reliably met, they started wanting a variety of things. In 1977, we discovered positional goods, which are goods whose value would be diminished if everyone had them. This dispersal of demand blindsided the mass production machine. Some industries, such as advertising, still haven’t entirely caught up. |

| Despite the marketing fluff, we are basically trending toward perfect competition, producing commodity products that are differentiated by price and availability. | The opportunities are in industries that are characterized by monopolistic competition: highly differentiated products with limited opportunities for customers to substitute. This carries greater risk because you have to guess what differentiators matter and bet your company that you’re right. |

| Low cost through economies of scale wins. | You can run your business into the ground producing a low-cost product that nobody wants because the quality is inferior or the public perception is bad. There are other economies to be had, such as economy of scope. |

| In the supply chain, the company with the access to capital has the upper hand and calls the shots. That is usually the manufacturer. | In the supply chain, the company with the access to customers has the upper hand and calls the shots. That is often the retailer (e.g., Wal-Mart, Amazon). |

| We have the know-how and the processes. Our focus needs to be on operating and optimizing. | Our processes are not always working for us. Other countries have come in to our markets and outperformed us. Our focus needs to be on innovation. |

| Business relationships are basically adversarial in nature. | Co-opetition reigns supreme. For every circle you can draw where you and others are in an adversarial relationship, you can draw a larger circle where you and the others in the smaller circle have to work together to compete against the others. |

These changes are external to business, larger than the American commercial environment. They are beyond the abilities of business management to change, even if they wanted to.

How did these changes influence the assumptions within the workplace?

| Old Assumption | New Reality |

|---|---|

| Labor is cheaper than capital. | Between the introduction of cheap computing power and increasing fully loaded compensation costs driven by employee health benefits, capital is now cheaper than labor. |

| Labor is more flexible than capital. | I can put a computer in the excess storage closet more readily than I can a person. Moreover, for a variety of factors, it is harder to get rid of people who I don’t need or who don’t work out. Therefore, I am now extremely reluctant to add people and only do it when I absolutely have to. |

| Most people aren’t capable of brain work. They need follow-the-horsie procedures to guide them through their working day. | There are far fewer places in this new climate for people who are not capable of brain work. More of the work to be done is knowledge work. I need people who can solve problems, not people who need me to solve problems so that they can do “their jobs”. |

| People come to work to do the least work for the most money. | A knowledge worker with no initiative is a bust. If I have to figure out what you need to do and tell you how to do it, we’re both doing your job. I could just as well do it myself. |